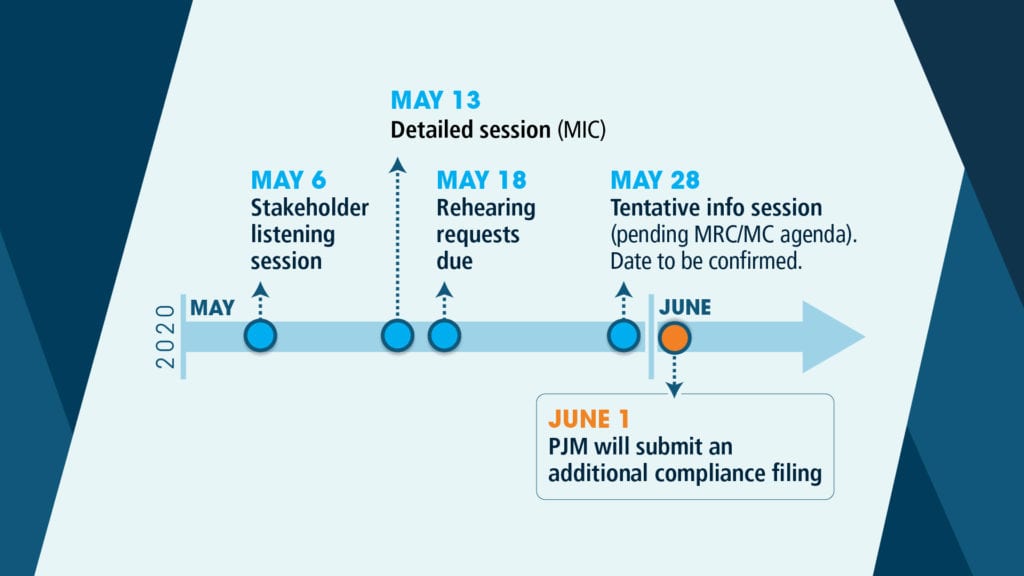

PJM will engage stakeholders in a series of meetings

before submitting by June 1 a second compliance filing addressing its capacity

market price rules, as directed by the Federal Energy Regulatory Commission

(FERC).

In response to several requests for a rehearing and

clarification of certain elements of FERC’s December order, which expanded the Minimum

Offer Pricing Rule (MOPR) used in the PJM capacity auction, on April 16 FERC largely

affirmed its order,

but provided some clarifications.

The December order significantly expanded the application

of the MOPR, which had previously only applied to new natural gas-fired

resources.

Prior to submitting its initial

compliance filing on March 18, PJM heard from every

stakeholder sector, conducting nine formal stakeholder meetings to discuss the

filing and surrounding issues.

PJM Seeks Input

Similarly, PJM is actively seeking to understand the

impact of the FERC order on its stakeholders as it prepares its second

compliance filing.

In a presentation

to the Markets & Reliability Committee on April 30, Lisa Morelli, Director

– Capacity, Demand Response & Compliance, shared PJM’s next steps, starting

with a May 6 special session of the Market Implementation Committee, 10 a.m. to

noon.

This will be followed by a dedicated discussion at the May 13 meeting of the Market Implementation Committee and a subsequent information session tentatively scheduled for May 28.

Two Points of Particular Interest

PJM is particularly interested in hearing from

stakeholders about the effects of the following points of the order:

- State default service procurements being

captured by the definition of “state subsidy” - Public power self-supply entities engaging

in voluntary, arms-length bilateral contracts with unaffiliated third parties

triggering the MOPR

In her update, Morelli highlighted several impacts of

the FERC order, including on MOPR floor prices, classification of new versus

existing capacity resources, and transactions.

Morelli said a large majority of PJM’s March

compliance filing stands, and that the new compliance filing will address

particular aspects of the recent FERC order.

PJM still proposes to run the 2022/2023 Delivery Year

auction approximately six months after FERC approves its compliance filings.

PJM would be able to run subsequent auctions with as

little as six months in between to help maintain an orderly process for each

auction while working to return to a normal auction schedule.

Original source: PJM