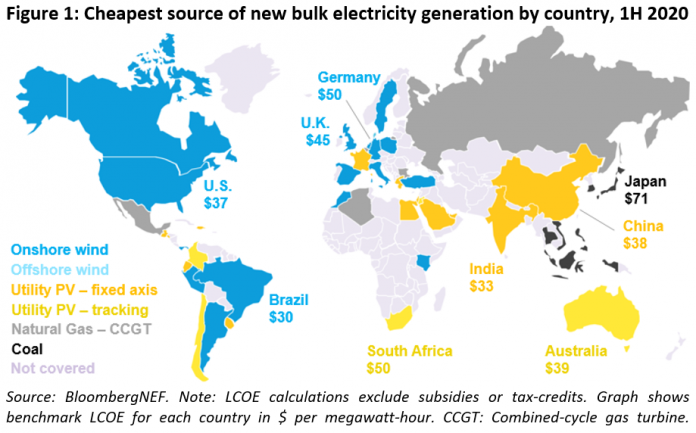

Solar PV and onshore wind are now the cheapest sources of new-build generation for at least two-thirds of the global population. Those two-thirds live in locations that comprise 71% of gross domestic product and 85% of energy generation. Battery storage is now the cheapest new-build technology for peaking purposes (up to two-hours of discharge duration) in gas-importing regions, like Europe, China and Japan.

The latest analysis by research company BloombergNEF (BNEF), Bloomberg’s primary research service that covers clean energy, advanced transport, digital industry, innovative materials and commodities, shows that the global benchmark levelized cost of electricity (LCOE) for onshore wind and utility-scale PV has fallen 9% and 4% since the second half of 2019 – to $44 and $50 per MWh, respectively. Meanwhile, the benchmark LCOE for battery storage has fallen to $150 per MWh, about half of what it was two years ago.

Onshore wind has seen its most significant drop in cost since 2015. This is mainly due to a scale-up in turbine size, now averaging 4.1 MW, and priced at about $0.7 million per MW for recently financed projects. The best-in-class onshore wind projects can achieve an LCOE of $24 per MWh, the lowest globally. Meanwhile top projects in the U.S., India and Spain follow at $26, $29 and $29 per MWh respectively, excluding subsidies such as tax-credits.

Globally, BloombergNEF estimates that some of the cheapest PV projects financed in the last six months will be able to achieve an LCOE of $23-29 per MWh, assuming competitive returns to their equity investors. Those projects can be found in Australia, China, Chile and the U.A.E., where they will challenge the existing fleet of fossil fuel power plants.

“There have been dramatic improvements in the cost-competitiveness of solar and wind. Part of it is due to photovoltaic and wind technology getting better at extracting renewable resources,” says Tifenn Brandily, lead author of the report at BNEF.

“But our analysis also suggests that since 2016, auctions are forcing developers to realize cost savings by scaling up project size and portfolios. Larger scale enables them to slash balance-of-plant, operations and maintenance expenses – and have a stronger negotiating position when ordering equipment,” adds Brandily.

Globally, BNEF estimates that the average onshore wind farm has doubled its capacity from 32 MW in 2016 to about 73 MW today. Solar farms are a third more powerful today, at 27 MW on average, compared to 2016.

Battery storage is another example of how scale can unlock cost reductions. BNEF estimates that the average capacity of storage projects sits at about 30 MWh, a fourfold rise compared to just 7 MWh per project four years ago. Since 2018, increasing project sizes combined with a rapidly expanding manufacturing base and more energy-dense chemistries, have halved the LCOE of energy storage.

“The coronavirus will have a range of impacts on the relative cost of fossil and renewable electricity,” says Seb Henbest, chief economist at BNEF.

“One important question is what happens to the costs of finance over the short- and medium-term. Another concerns commodity prices – coal and gas prices have weakened on world markets. If sustained, this could help shield fossil fuel generation for a while from the cost onslaught from renewables,” he adds.

To read BloombergNEF’s full press release concerning the falling LCOE of wind and solar energy, click here.

Original source: North American Wind Power