Energy trading company Danske Commodities has signed a 15-year offtake power purchase agreement (PPA) for 480 MW with the world’s largest offshore wind farm, Dogger Bank.

Under the agreement, Danske Commodities will be responsible for the trading and balancing of 480 MW.

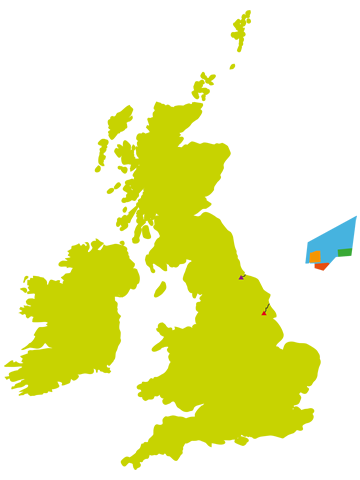

Dogger Bank Wind Farm is owned by Equinor (50%) and SSE Renewables (50%) and is located 130 km off the coast of Yorkshire in the U.K. With a total capacity of 3.6 GW, Dogger Bank is set to become the world’s largest offshore wind farm.

The Dogger Bank wind farm consists of three phases; Dogger Bank A, Dogger Bank B and Dogger Bank C. Each phase accounts for 1.2 GW of the farm’s total capacity of 3.6 GW. Danske Commodities will offtake power from the first two phases, Dogger Bank A and Dogger Bank B.

“Signing a long-term PPA with the world’s largest offshore wind farm cements Danske Commodities’ position as an energy trading company,” says Helle Østergaard Kristiansen, CEO of Danske Commodities.

“We are constantly growing our market position in the renewables space to support the energy transition with our knowledge in trading and balancing,” Kristiansen adds.

The Dogger Bank agreement adds to Danske Commodities’ growing presence in the PPA market. Last year, the energy trader inked a 20-year PPA with Hywind Scotland wind farm (the world’s first floating wind farm), a 15-year PPA with Sheringham Shoal wind farm and a 15-year PPA with Dudgeon wind farm as part of a planned novation from owner Equinor.

The offtake power purchase agreement is subject to financial close on Dogger Bank A and Dogger Bank B, expected late in the year.

Photo: Project map of the Dogger Bank Wind Farm

Original source: North American Wind Power