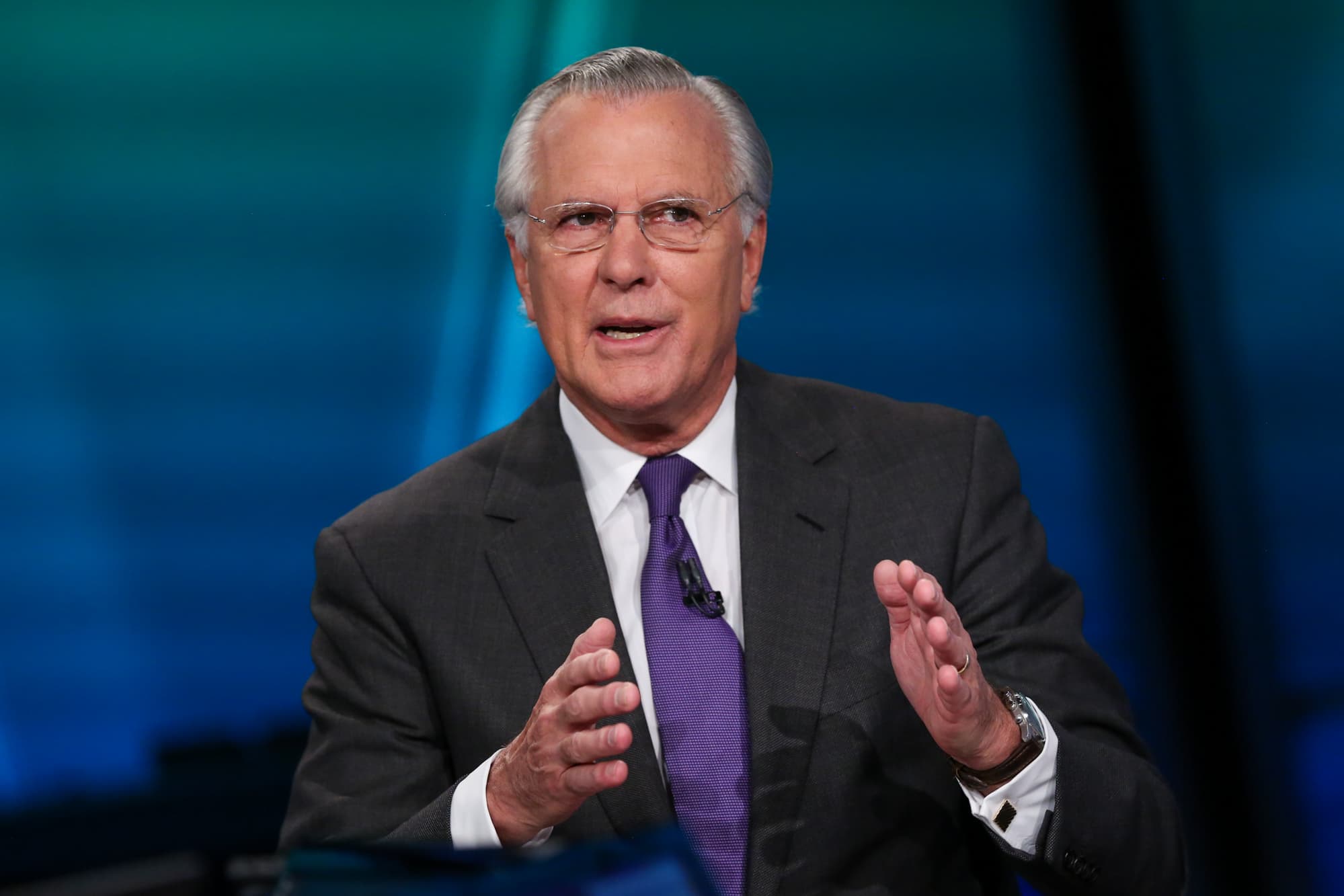

Texas has been slammed by the collapse in oil prices and the recovery ahead for the area and the national economy as a whole will be slow, former Dallas Federal Reserve President Richard Fisher said Tuesday.

West Texas Intermediate crude prices plunged into negative territory Monday, the first time that has happened, as slumping demand and over-supply distorted energy market dynamics.

Fisher said his state is looking to restart slowly an economy that has been bruised by the oil slump.

“We are all, particularly in the Houston area and West Texas, being hit hard by what happens in the energy patch,” Fisher told CNBC’s Rick Santelli during a “Squawk on the Street” interview.

Fisher added that he anticipates a slow road ahead as the economy recovers from a coronavirus-induced shutdown.

“Texans get things done. The order of difficulty is great,” he said. “We’re in for a long, U-shaped recovery in the United States as a whole. It’s going to take time to patch things back together, to get them up and running, to get the financing for working capital for small- and medium-sized businesses to lift up the economy, bring people back to work and start growing again. It’s going to take quite a while.”

Fisher pointed out that it’s not only oil getting hit but also other goods across the commodity spectrum including copper, wheat, soybeans and corn. That all has happened as the dollar has strengthened but government bond yields have remained low.

Whereas the benchmark 10-year low normally would average about 4% over time, he added, it’s now closer to 0.5%, which he said sends the message to members of Congress that “you can spend eight times as much” but still have the same financing costs.

The U.S. national debt has ballooned to nearly $24.5 trillion and the budget deficit this year is expected to eclipse $3 trillion.

Fisher said low rates are making those costs affordable, but also have a downside.

“It’s kind of a good thing, but it’s also a dangerous trap,” he said.

Original source: CNBC